Children’s Miracle Network Hospitals want you to check out a new holiday catalog full of electronics and toys. I know what you’re thinking… But these electronics include heart monitors to check the vital signs of sick babies, and these toys are used to brighten a child’s day during a long stay at the hospital.

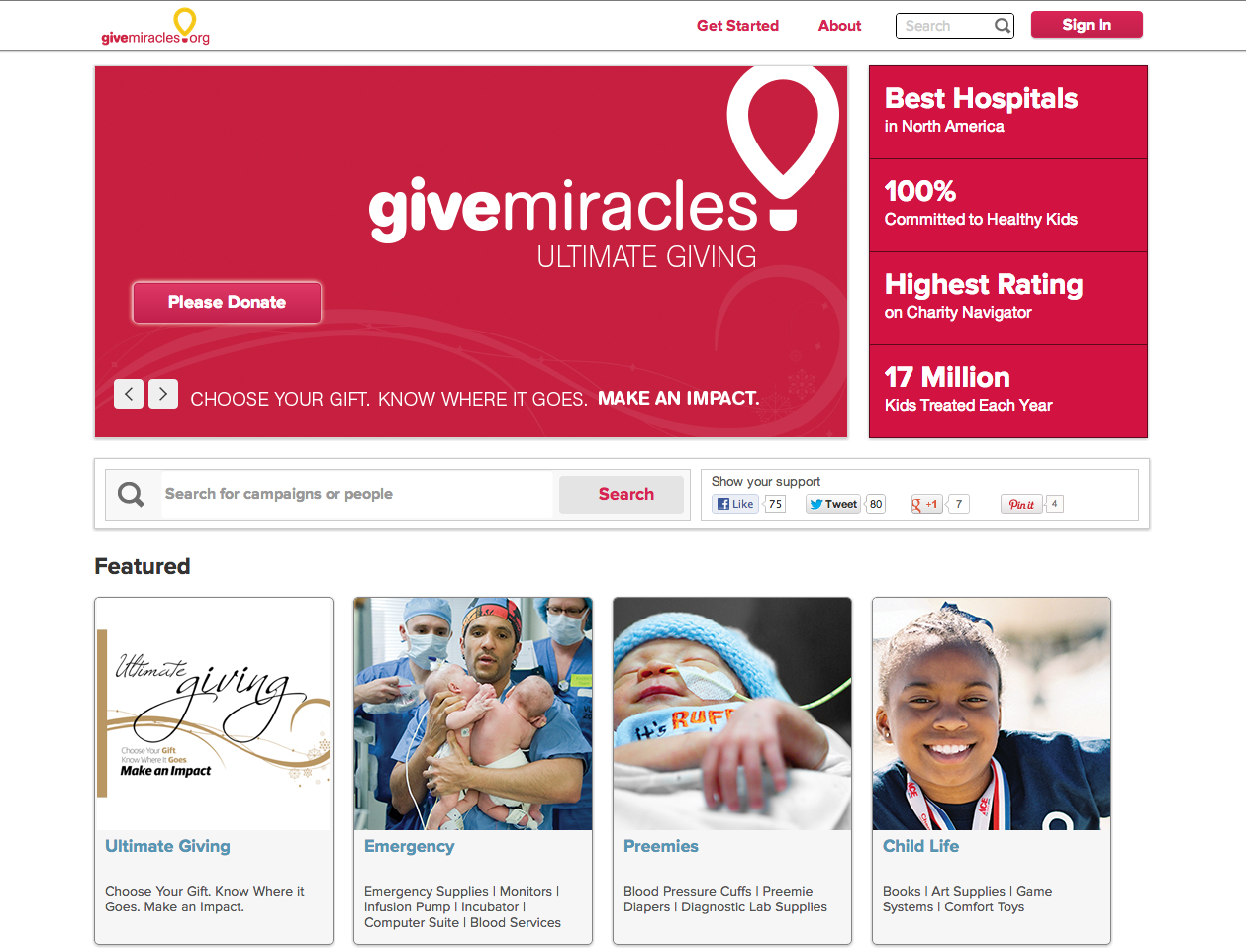

The Give Miracles campaign uses crowdfunding to add a twist of social media to your holiday gift giving. “What if people could actually get together and donate in groups of people,” asks CMN Hospitals Chief Concept Officer Craig Sorensen, “maybe you have $20 to give, $100 dollars to give, or $100,000 dollars to give to your local Children’s Miracle Network Hospital, but you could go all in together and crowdfund an item.”

The platform being used for the Give Miracles campaign is Fundly, and CEO Dave Boyce says the model treats the $100 dollar donor like the $100,000 dollar donor. “The thing that’s frustrating for most of us mere mortals who donate $50 or $100 at a time is that we never know where our money goes, and we never get any of the psychic benefit that we thought we were going to get from donating,” Boyce explains.

That’s all changing now, because donors will not only choose which hospital they want to support – but they’ll decide where they want their money to go, and whether to fund a specific need completely or become part of a larger project. Campaign subscribers then receive regular updates on their chosen project, which allow them to track where their money is going and who else in their social networks is joining them.

In Pennsylvania, Children’s Hospital of Philadelphia, Children’s Hospital of Pittsburgh, Penn State Hershey Children’s Hospital, Saint Vincent Health Center and Geisinger’s Janet Weis Children’s Hospital are all a part of this unique campaign.

Children’s Hospital of Philadelphia

Children’s Hospital of Philadelphia is actually one of eight hospitals, nationwide, which are being featured for an Ultimate Gift. “We have one of the very best autism research and treatment programs in the world,” says CHOP’s Chief Development Officer Stuart Sullivan. “We thought if we got a significant investment from a donor we could do even more.” Their goal: $7.5-million dollars.

Children’s hospitals help more kids than any other organization in a community, according to Craig Sorensen, who also notes that they aren’t always top of mind as a cause organization. That’s why Sorensen hopes the Give Miracles campaign becomes an annual tradition.