Lawmakers Mull Expanded Education Tax Credit

Potential education reforms are being debated under the capitol dome ahead of Saturday’s state budget deadline. One of them would expand the state’s Educational Improvement Tax Credit (EITC) program with a sub-program that targets low-income families in the state’s worst performing schools. It was characterized at Monday’s House Education Committee hearing as “EITC 2.0.”

While the existing EITC program has long enjoyed bipartisan support, critics are characterizing the proposed expansion as a school vouchers program. “85% – 90% of the kids who would get those vouchers are already in private schools,” says minority education chairman James Roebuck (D-Philadelphia). “It’s not a means to get kids out of so-called failing public schools… it’s a subsidy to private education.”

But the bill’s prime sponsor says it’s irresponsible to characterize his effort as school vouchers. “Despite the fact that the student leaves to go to another school, their state, local and federal dollars remain in that classroom – thus elevating significantly the per-pupil spend of those classrooms they are leaving,” explains state Rep. Jim Christiana (R-Beaver). He tells the House Education Committee the scholarships would be funded by businesses that choose to participate in the tax credit program.

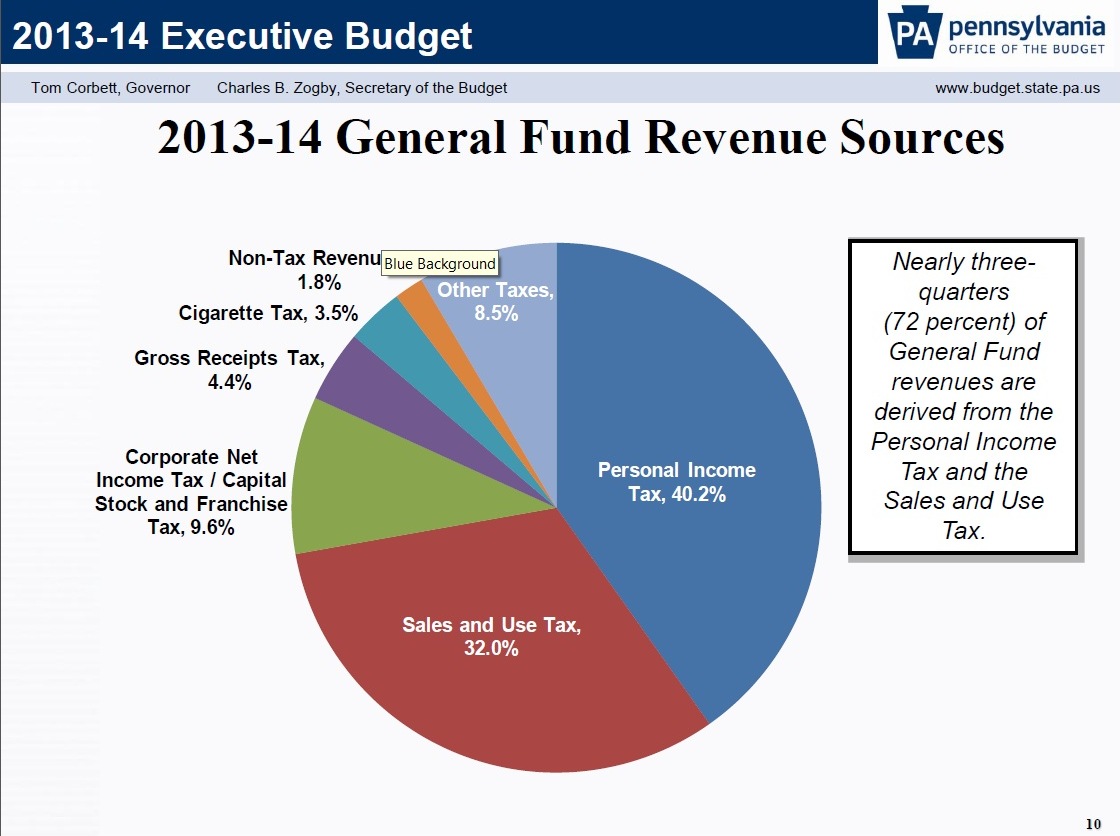

The Pennsylvania School Boards Association (PSBA) opposes the bill, because they say it would siphon valuable dollars from the General Fund at a time when school districts are struggling.

While it appears the push is on to pass an expanded EITC along with the state budget, Republican chairman Paul Clymer (R-Bucks) characterized the bill as a work-in-progress.