House Committee Clears Transportation Bill With Major Amendments

The state House Transportation Committee has approved a highway, bridge and mass transit funding bill, making significant changes to the senate version.

The amended bill would provide nearly 2 billion annually for transportation by year five, primarily through a three step phase-out of the cap on the oil company franchise tax. The bill also increases the tire tax, vehicle lease fee and jet fuel tax. It would raise the fine for failure to obey a traffic control device from $25 to $75.

Counties could assess a 5 dollar per vehicle registration fee for local transportation needs, and municipalities could increase the realty transfer, earned income and sales and taxes to raise money for mass transit.

Another significant change from the Senate bill is the sunsetting of the Pennsylvania Turnpike’s Act 44 obligation to the Pennsylvania Department of Transportation. The 200 million dollar a year transfer for roads and bridges would stop immediately. The 250 million dollar annual contribution for mass transit would continue for eight years then be replaced by money from vehicle sales tax revenues.

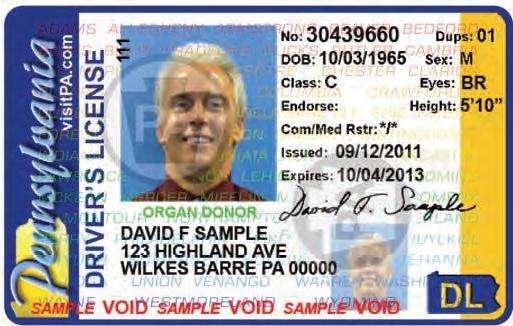

The bill eliminated the higher driver’s license and registration fees and a 100 dollar surcharge on traffic violations contained in the original senate version.

Representative Steve Santarsiero (D-Bucks) was a “no” vote. He says they may not get another bite at the apple again for some time, since the last major transportation funding bill was passed in 1996. He says the bill does far too little to seriously address the state’s transportation problems.

But Transportation committee chair Dick Hess (R-Bedford) says it was a yeoman’s job to craft something to benefit Pennsylvania economically, while not overburdening consumers. He says there will be an opportunity to amend the bill on the house floor.