Q1 State Revenues Miss the Mark

The first quarter of the state’s fiscal year is in the books, and the numbers tell the tale of a flagging economy. “All the major tax categories were below estimate for the month, so clearly the economic conditions are having an impact on tax collections,” says state Revenue Department spokeswoman Elizabeth Brassell, while discussing the latest revenue report.

September’s General Fund collections were $151.8-million (6.1%) below estimate, which means state revenues are now $215-million (3.5%) below projection for the fiscal year-to-date. Sales taxes have come in 1.4% below estimate, personal income taxes are 4% off the mark, and corporation taxes are nearly 13% less than anticipated so far this fiscal year.

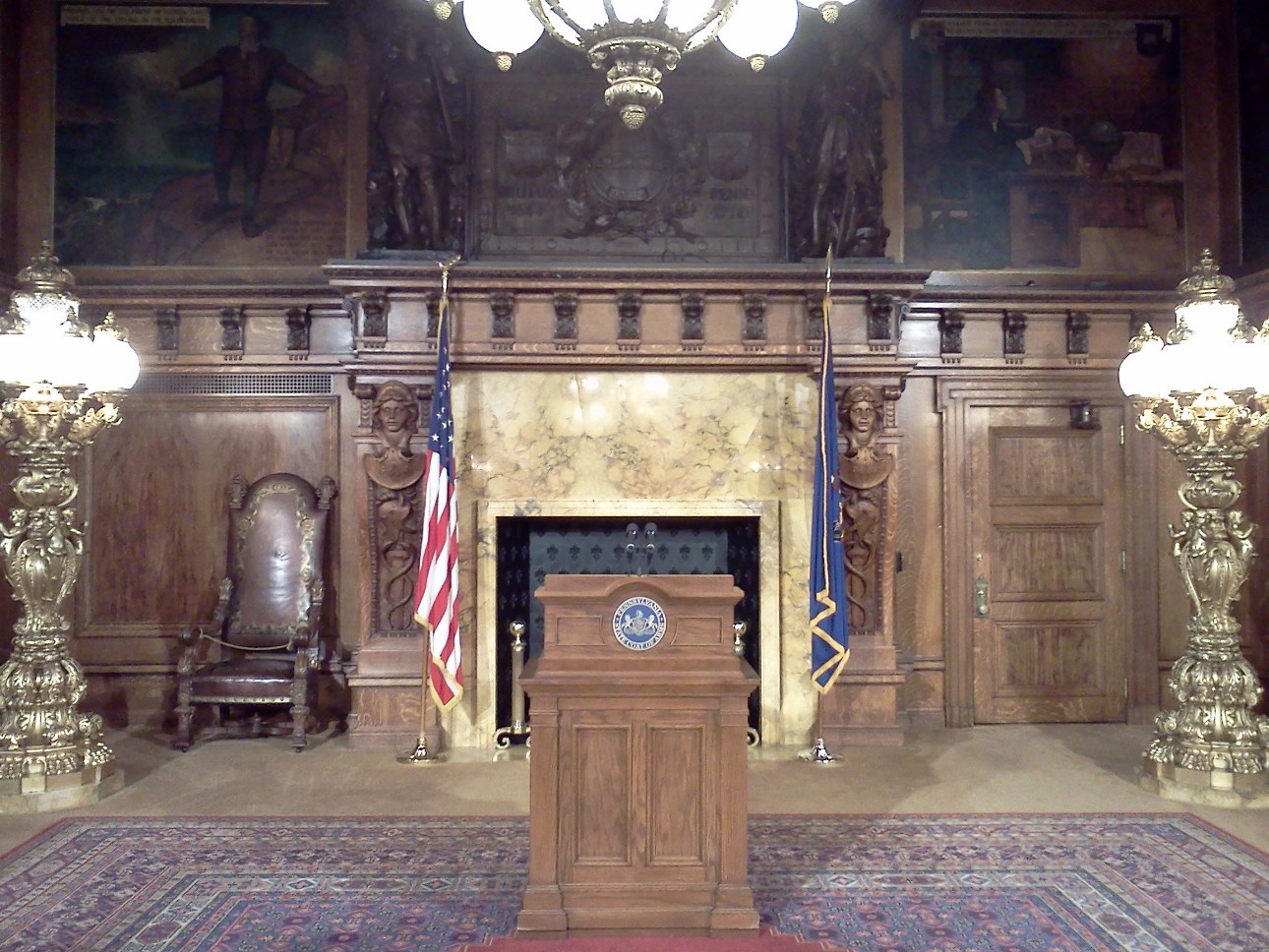

Governor Tom Corbett says he’s watching the situation closely and is paying particular attention to the month of October. “We kept aside $700-million. Our goal was to go into next year with $500-million on hand, you’d kind of like to have money on hand going into it,” Corbett said during a question and answer session with the media on Wednesday.

The $700-million that Corbett refers to was the unallocated revenues remaining at the end of FY2011. Corbett continues to stress that was not a surplus. “If the revenue decline isn’t indicative of that, I don’t know what else is.”