Democrats, Republicans Both Talking Delaware Loophole

A group of House Democrats is displeased with the new Republican-led attempt to close the so-called Delaware Loophole, but the two sides appear to be getting closer in the process. The Delaware Loophole essentially allows large, multi-state corporations to avoid paying Pennsylvania business taxes.

Back in January, Republican Rep. Dave Reed (R-Indiana) introduced a bipartisan bill aimed at closing that loophole through the ‘expense add-back’ provision. But Democratic Finance Chair Phyllis Mundy (D-Luzerne) calls it window dressing. “The language is so broad and riddled with exceptions that it’s ineffective and meaningless in terms of closing the Delaware Loophole,” Mundy explained at a capitol news conference on Wednesday.

Mundy still believes the best way to go about that is through a process called ‘combined reporting,’ but she recognizes the political will isn’t there, and now advocates what she calls a better version of the ‘expense add-back’ provision. She contends the Reed bill would actually create a ‘loophole within a loophole’ by allowing companies to deduct expenses they deem to be for legitimate business purposes. “Corporations would have little trouble finding a reason to claim a legitimate business purpose in order to avoid paying their fair share of taxes.”

Rep. Reed sees the new developments as a positive step. “I am just glad that Representative Mundy has finally come to the conclusion that there’s not support for combined reporting in Pennsylvania, and that an add-back provision is the better methodology of closing the Delaware Loophole, and that the revenue should be used for tax fairness across the board,” Reed tells Radio PA.

Both lawmakers support plans that would use the newfound revenue to gradually lower the state’s corporate tax rate from 9.99% to 6.99% over the course of six years.

Reed says that unlike combined reporting, the add-back provision would target only the companies actually using the loophole. He anticipates a House Finance Committee hearing to be scheduled on the topic later this month.

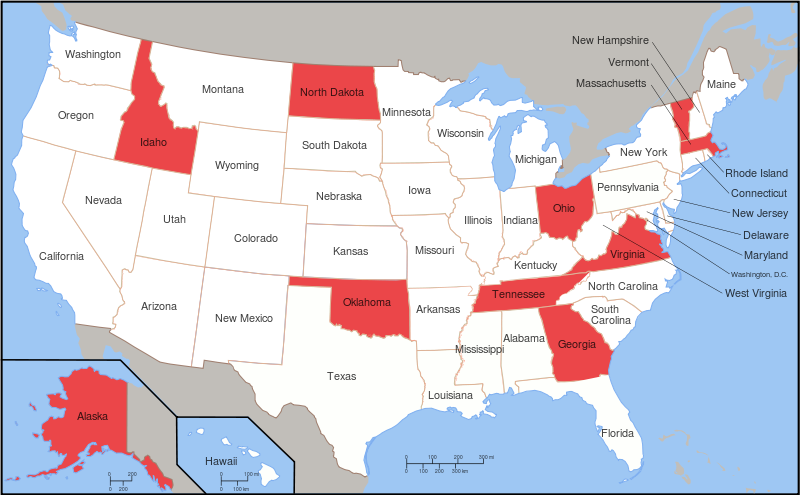

Currently 35-states use either ‘combined reporting’ or ‘expense add-back’ as a way to promote business tax fairness.