U.S. House Subcommittee to look into Identity Theft Involving Tax Refunds

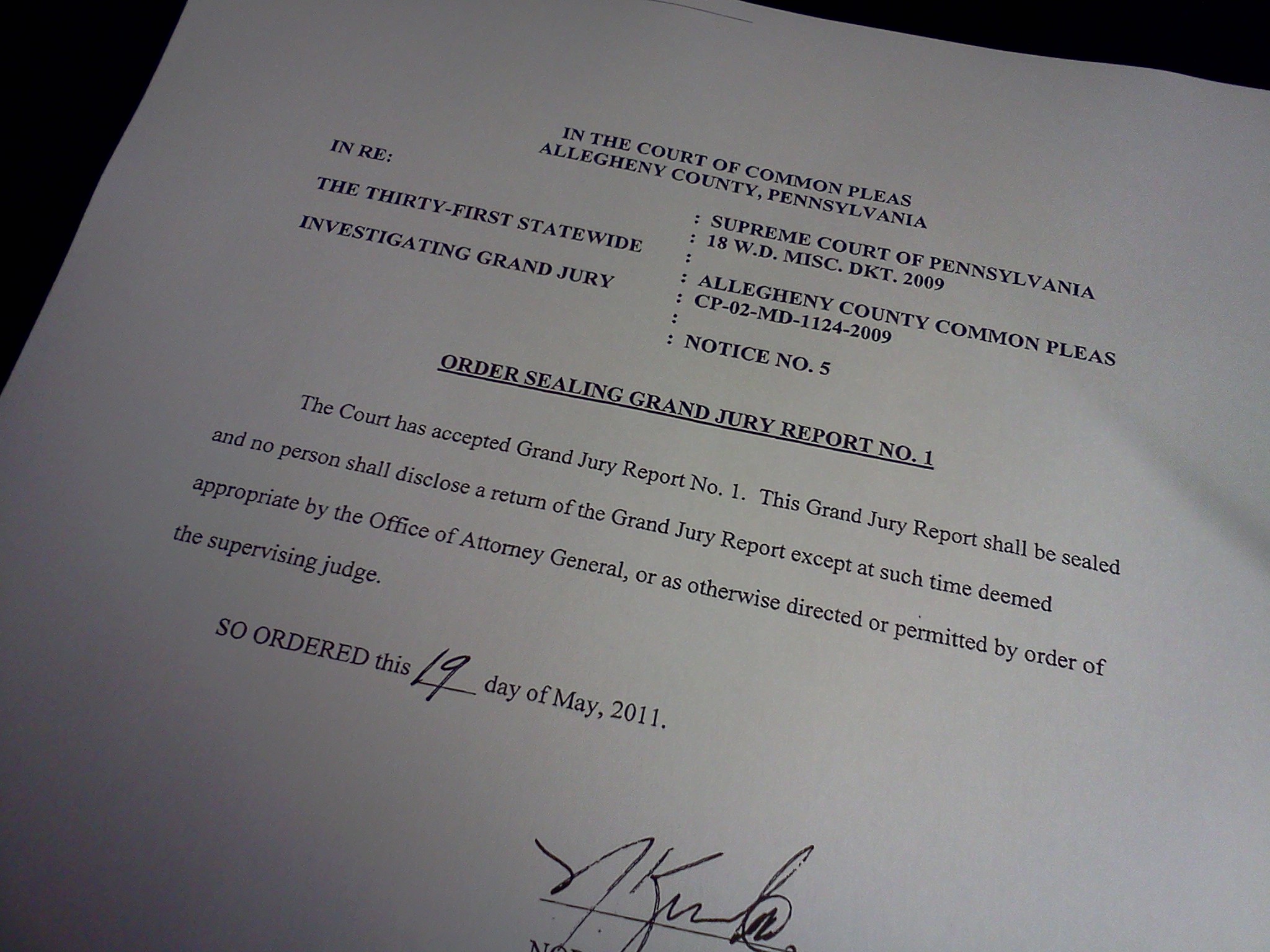

A United States House subcommittee plans to hold a hearing next week on a growing problem- identity thieves who use stolen Social Security numbers to claim other people’s tax refunds. The scam starts with an identity thief obtaining a Social Security number through a variety of methods, such as phishing scams or malicious software. The thief then uses the number to file a tax return electronically. The fraudulent returns are filed early and the refund is often applied to a prepaid credit card.

David Stewart, a spokesman for the Internal Revenue Service, says just this year alone, the IRS has stopped nearly 117,000 identity theft returns and protected more than $582 million from getting into the wrong hands. He says the IRS works with the Department of Justice to criminally prosecute ID theft cases.

The U.S. House subcommittee on Government Organization, Efficiency and Financial Management has scheduled a hearing on the issue for June 2nd.

Stewart urges taxpayers to guard their Social Security numbers carefully and avoid opening suspicious emails or suspicious links online.

He says the preventing identity theft is a top priority at the IRS, and they have committed significant resources to addressing and resolving cases of taxpayer identity theft.

The IRS processes more than 142 million tax returns annually and issues over 109 million refunds. If a victim of ID fraud files electronically, Stewart says they will get notification from the IRS indicating that they’ve already filed, because their Social Security number has already been used. He says the IRS is committed to working with taxpayers who are victims of such scams.